In these circumstances and challenges which the industry faces, It becomes a must to have an analytical view on what is happening and to take an action as a student and researcher in this time.

the main problem is not the reserve, It is the consumption. The world is addicted to petroleum. The era of fossil fuels is still running. The question now, What will come after this era "the peak" ? Nano technology, renewable energy, nuclear energy or what?! How will the transition be? smooth or hard...?! Does that mean no operations will be in the industry then ?!

Let's begin with Hubbert Curve

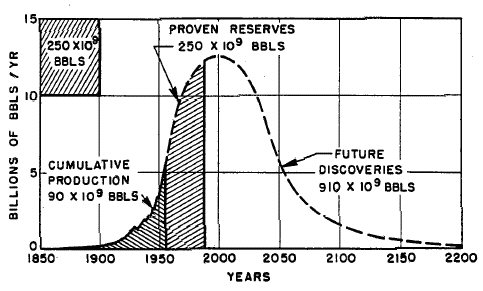

The Hubbert peak theory states that the rate of fossil fuels production such as oil tends to follow a bell-shaped curve. The theory was created in 1950 by the American geologist M. King Hubbert.

Hubbert's peak can be used to observe the peaking of oil production in a particular region. Based on his theory, Hubbert made a report for the American Petroleum Institute in 1956, which predicted that the oil production from discovered oil sources would peak in the U.S somewhere between 1965 and 1970. He described two scenario's in his report :

- most likely scenario: a production curve with a growth rate of 6%, a total of 150 Giga-barrels (Gb) of oil and an oil peak in 1965.

- second scenario: a production curve with a production growth rate of 6%, a total of 200 Gigabarrels (Gb) of oil and an oil peak in 1970.

The United States reached Hubbert's peak in 1970 as predicted. The U.S production of oil reached a peak of 10,200,000 barrels per day. Since then, the U.S oil production has been in decline.

Hubbert's peak, better known as peak oil, is often used more generally, to refer to the moment in time when the entire planet's oil production peak occurs. After this moment, according to the Hubbert Peak Theory, the rate of oil production on the world would enter a terminal decline.

Hubbert predicted in his report, which was published in 1956, global peak oil would occur "about half a century from now". In a TV interview in 1976, Hubbert remarked that the actions of OPEC might flatten the curve of global oil production, but this would only delay the peak for at most a decade.

Criticism

The former vice president of the Italian energy company Eni, Leonardo Maugeri, points out that the Hubbert peak predictions do not take into account unconventional oil even though there's a large amount of these resources available. He admits the costs to extract oil from these sources are very high, but are falling because of new technology. He also argues that the extraction rate from oil sources has increased from 22% in 1980 to nearly 35% because of improved technology and believes this trend will continue.

The economist Edward Luttwak, argues that unrest in nations such as Russia, Iran and Iraq has led to an incorrect estimate of oil reserves. ASPO (The Association for the Study of Peak Oil and Gas) responds by arguing that there is only unrest in Iraq currently and not in Russia and Iran.

Conclusion:

Like everything in the universe, Petroleum must have an end. Sooner or later, it is a matter of time. the price crisis is not controlled by reserve or production as much as the political decisions and economic polars. Looking at Hubbert Curve as a theory, I remember Stefan Hawking saying in his book, A Brief History of Time, "one of the basic rules of the universe is that nothing is perfect. Perfection simply doesn't exist. Without imperfection, neither you nor i will exist".

Relying on this fact beside working on new technologies and opportunities, we can thrive in downturn.

The discussion is open and I would like to know your opinions about this era predicting the upcoming ...